The video KYC verification enhances the operations and activities of the organizations. The businesses verify the profile of their users and ensure that they are not entangled in any mysterious acts. The customers perform the video authentication of the users and check that it is safe to collaborate with such business partners.

Introducing the Video Call for KYC Verification

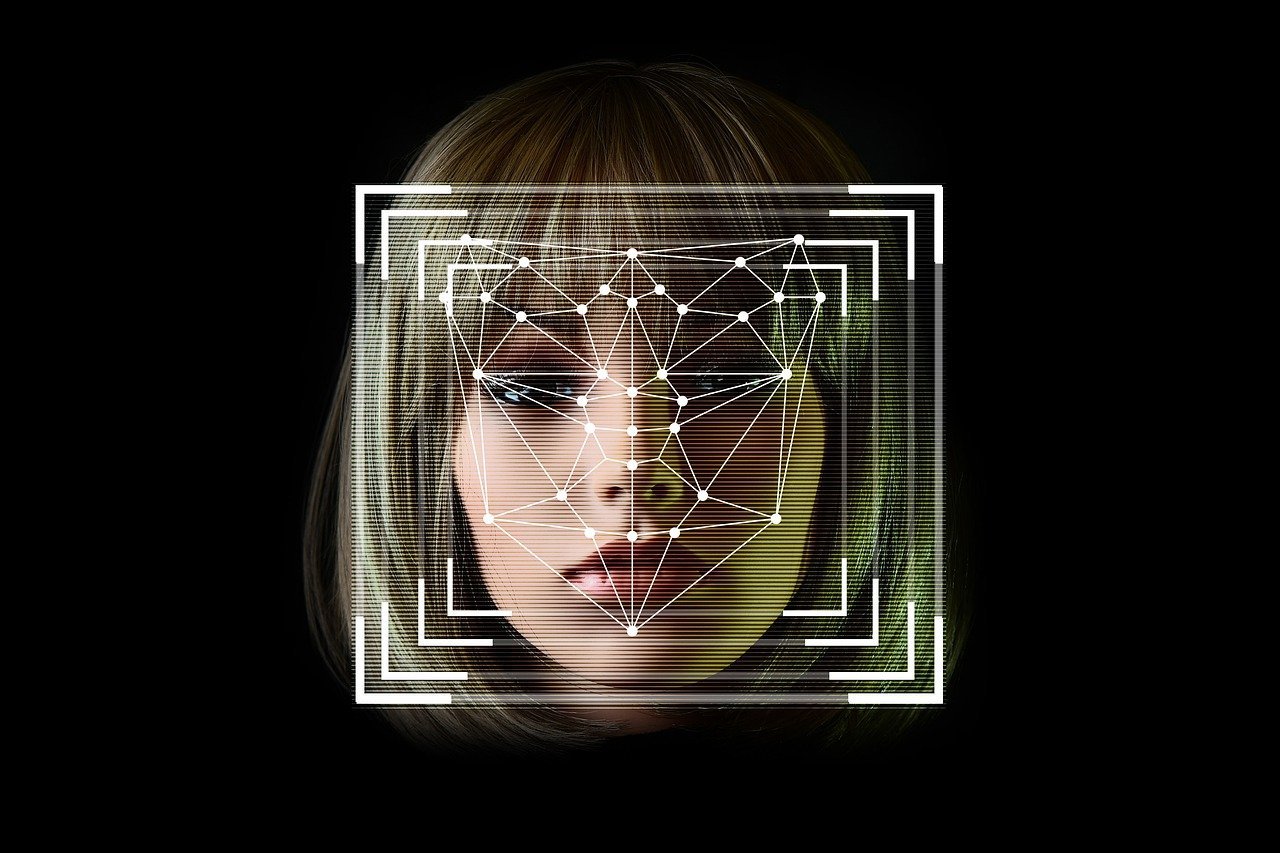

KYC video identification is a remote process employed to check the validity of the users. The organizations do not require the actual presence of the clients, they verify the identity of the clients through the video. The KYC agent performs this verification, and then the client also has to submit their documents. The users upload the soft copy of their papers, they do not have to send the hard form of their records.

Working of the KYC Verification Process

There are the following two types of authentication:

- Manual Verification

The manual KYC validation is done by the manuals, this is an in-person verification. The clients have to be present over there, other than this they have to submit the hard copy of their papers. When the user visits the company for account opening, the KYC agent performs their verification. The manual process is time-consuming, and they are not very valid, because there are chances that the operator may perform the wrong process. Therefore organizations do not prefer this kind of verification.

- Video KYC

Digital KYC verification is done by artificial intelligence tools, and the companies do not require a large number of employees. It is an online process, businesses can ensure that they are associating with the right individuals.

How Does Video KYC Process Combat Spoofing Attacks?

- The hackers perform spoofing attacks to get access to the client’s account. The scammers use the fake account and perform the phishing, they try to decode the algorithm. KYC video identification is employed to control such types of fraudulent activities. The scanner thoroughly checks the profile of the customers, they ensure that the client is live. Any kind of 3D or silicon mask is not trying to get access.

- Scammers mostly use the stolen account to bypass the scanner, it is difficult to identify the fake identity. The Video KYC verifies the account of the client. Compare their physical or physiological characteristics with the already stored templates. if both are similar then the green flag is shown, otherwise, the verification will be rejected.

- Deep fakes are also used to get unauthorized access, to control such activities, the system uses deep learning methods to bypass the security. The organizations employ video KYC verification, to deeply check that the live customer is present in front of the camera. The system immediately detects the mysterious activities and responds to the respective authorities.

Which Industry Can Benefit from the Video KYC?

Biometric solutions have shown remarkable benefits in almost every industry, organizations can preserve their record through these tools. The following industries are employing video KYC verifications, in their daily authentications.

- Financial Institutes

The banks hold the personal data of their users, the clients feel hesitant while sharing their information with the companies, therefore the organizations have to build the trust of the users. The businesses employ artificial intelligence tools, to preserve the account of the customers so that only actual clients will be given access to the system. In the banks, these tools are used to operate the account of the customer, perform their verification and measure their activity.

- Payment Industry

In the payment industry money laundering cases are very common, and the data of the customers is not in safe hands. The companies and the clients have to face heavy costs due to such scams. Organizations must have to use machine learning tools to preserve their personal information. This aids in satisfying the credentials of the client so that they can easily share their bank information and perform the transactions. The businesses that are using these services, can observe a significant rise in their revenue because they are secured against money laundering.

Conclusion

The video KYC verification is done to ensure that the live client is present in front of the scanner. Organizations can secure their data and personal records from scammers, other than this they can control the data breach issues. In this digital era, it is essential to follow the latest trends, so that they can survive in this competitive era. Businesses must have to use these solutions in their daily life so that they do not require a large number of employees. Advanced tools are employed to perform the onboarding and monitoring of the customers.